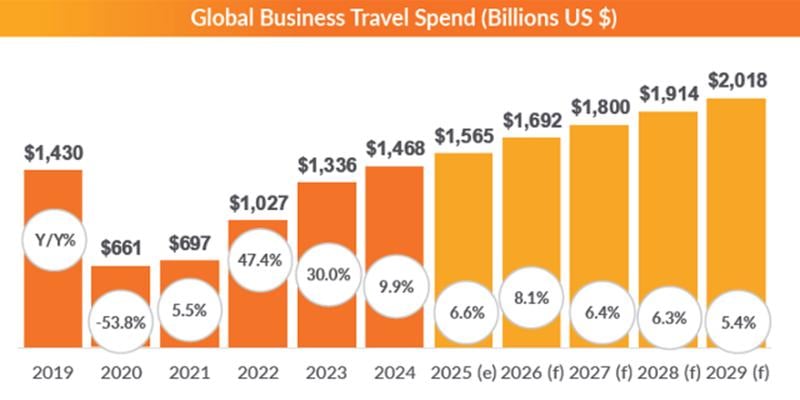

Global business travel spending is expected to reach a record $1.57 trillion in 2025, according to the latest GBTA Business Travel Index (BTI) Outlook – Annual Global Report & Forecast, released by the Global Business Travel Association at its annual convention in Denver. This marks a moderate year-over-year growth rate of 6.6 percent, as global spending is expected to slow this year due to trade tensions, policy uncertainty and economic pressures. A stronger rebound to 8.1 percent growth is projected for 2026, though longer-term forecasts remain clouded by ongoing geopolitical and economic volatility.

Despite near-term challenges, global spending is projected to surpass $2 trillion by 2029─one year later than anticipated a year ago─driven by structural shifts in trade, investment, and corporate travel behavior.

Produced in partnership with Visa, the GBTA BTI report offers a comprehensive five-year outlook for business travel spending across 72 countries and 44 industries, drawing insights from more than 7,300 global business travelers. Now in its 17th edition, the latest forecast points to a continued recovery in nominal terms but also highlights growing challenges from global trade tensions and economic uncertainty.

According to the GBTA BTI, spending is projected to grow in 2027 by 6.4 percent and 6.3 percent in 2028—modestly higher than forecast a year ago. The pace and trajectory of this growth, however, will depend heavily on the resolution—or escalation—of global trade tensions.

Global Trade Tensions Impact Growth Momentum

- The latest forecast reflects a moderation from double-digit gains of the past two years. Trade policy uncertainty has emerged as a key risk leading to downward revisions in business travel growth projections for 2025 (from 10.4 percent projected a year ago, to 6.6 percent now) and 2026 (from 9.2 percent projected a year ago, to 8.1 percent now).

- Spending figures for 2024 were also adjusted in this latest forecast—spending rose to $1.47 trillion, slightly below the previously projected $1.48 trillion. While this still marked a new high, real inflation-adjusted spending remains 14 percent below pre-pandemic levels, underscoring a slower recovery in travel volume.

Impacts Diverge Among Regional Markets and Industry Sectors

- In the 2025 forecast, the top 15 markets for business travel spending represent $1.31 trillion. The two top markets—the U.S. ($395.4 billion) and China ($373.1 billion)—together represent 58 percent of that total.

- The U.S. is projected to reclaim the top spot this year followed by China (which led the list in 2024 and 2023), Germany, Japan, and the U.K.

- India, South Korea, and Turkey are among the fastest growing among the top 15 markets, while Spain and the Netherlands are forecast to have little to no growth or a slight decrease.

Business travel spending across industries will also continue to vary:

- Trade-sensitive sectors such as Manufacturing (which accounts for nearly one-third of global business spending) and Wholesale Trade face heightened risks if trade tensions further escalate.

- Service sectors like Arts & Entertainment and Professional Services have exceeded pre-pandemic benchmarks, with some growing travel spend by over 20 percent.

- Looking ahead, Mining and Information and Communication are each expected to post the strongest growth in business travel spend, while Agriculture faces the weakest outlook amid shrinking access to export markets.

Global Business Traveler Sentiment Remains Strong

A global survey of over 7,300 business travelers across 33 countries in North America, Europe, Asia Pacific, Africa, Latin America and the Middle East reveals continued evolution and confidence in the value of traveling for work:

- Business travel is seen as valuable—86 percent rate their trips as worthwhile. Primary trip purposes cited vary by region, with training and conferences topping the list globally.

- Most travelers (74 percent) took between one and five trips in the past year, and over 80 percent say they are traveling for work as much or more than before 2019.

- Average trip spending rose to $1,128 USD (up from $834 in the 2024 survey).

- Expense systems are common (67 percent use them), and comfort with artificial intelligence booking tools is growing, especially in Asia Pacific (78 percent).

- Corporate card access rose to 69 percent, led by North America (73 percent). However, only half of cardholders are required to use them. Mobile wallet use is also up, with 64 percent adoption globally and 72 percent in Asia Pacific.

Download the 2025 Business Travel Index Outlook report Executive Summary here.

To learn more about GBTA Research or inquire about GBTA BTI™ data for 2000-2029, visit the GBTA webpage or email [email protected].

Related Stories

IACC and DCI Release 2025 “Meeting Room of the Future” Report

FCM M&E Report Looks Into Shifts Driving Meetings Industry

JW Marriott Orlando, Grande Lakes Named Cvent Top Meeting Hotel